What Are Three Basic Functions Of Money?

thirteen.i The Functions of Coin

Learning Objective

- Identify the functions of money and draw the three government measures of the money supply.

Finance is about money. And then our first question is, what is money? If you happen to have ane on you, take a look at a $5 pecker. What you'll see is a piece of paper with a moving picture of Abraham Lincoln on 1 side and the Lincoln Memorial on the other. Though this piece of paper—indeed, coin itself—has no intrinsic value, it'south certainly in demand. Why? Considering money serves three basic functions. CoinAnything commonly accepted equally a medium of exchange, measure of value, and store of value. is the following:

- A medium of substitution

- A mensurate of value

- A store of value

To get a meliorate idea of the role of money in a modern economy, let's imagine a system in which there is no coin. In this system, goods and services are bartered—traded directly for i another. Now, if you're living and trading under such a organisation, for each barter substitution that y'all make, you'll have to have something that another trader wants. For example, say y'all're a farmer who needs help immigration his fields. Because y'all have enough of food, you might enter into a barter transaction with a laborer who has time to clear fields only non enough food: he'll clear your fields in return for three square meals a solar day.

This arrangement will piece of work as long as two people have exchangeable assets, but needless to say, it can exist inefficient. If we identify the functions of money, we'll run into how information technology improves the substitution for all the parties in our hypothetical set of transactions.

Medium of Exchange

Money serves equally a medium of exchange because people will accept it in exchange for goods and services. Because people tin can use money to buy the goods and services that they desire, everyone's willing to merchandise something for money. The laborer will accept coin for clearing your fields because he tin can use it to buy nutrient. Y'all'll take money as payment for his food considering y'all can use it not only to pay him but also to buy something else you lot need (possibly seeds for planting crops).

For money to be used in this manner, it must possess a few crucial properties:

- It must be divisible—easily divided into usable quantities or fractions. A $5 neb, for example, is equal to five $1 bills. If something costs $3, yous don't have to rip up a $5 beak; you can pay with 3 $1 bills.

- Information technology must be portable—easy to carry; it tin can't exist as well heavy or bulky.

- Information technology must exist durable. It must exist strong enough to resist trigger-happy and the print tin't launder off if it winds up in the washing machine.

- It must be difficult to counterfeit; it won't have much value if people can make their own.

Mensurate of Value

Money simplifies exchanges considering it serves as a measure of value. We country the cost of a practiced or service in monetary units and then that potential exchange partners know exactly how much value we want in return for information technology. This practice is a lot ameliorate than bartering because information technology's much more precise than an ad hoc understanding that a day'southward work in the field has the same value equally three meals.

Store of Value

Money serves as a store of value. Because people are confident that money keeps its value over time, they're willing to save it for time to come exchanges. Under a bartering system, the laborer earned three meals a day in exchange for his work. Simply what if, on a given twenty-four hour period, he skipped a meal? Could he "save" that meal for another twenty-four hours? Maybe, merely if he were paid in money, he could determine whether to spend it on food each twenty-four hours or save some of it for the future. If he wanted to collect on his "unpaid" meal two or three days later, the farmer might non be able to "pay" it; unlike coin, food could go bad.

The Coin Supply

Now that we know what money does, let's tackle some other question: How much coin is there? How would you become about "counting" all the money held by individuals, businesses, and government agencies in this country? Yous could start past counting the money that'southward held to pay for things on a daily footing. This category includes cash (paper bills and coins) and funds held in demand depositsChecking accounts that pay given sums to "payees" when they need them. —checking accounts, which pay given sums to "payees" when they demand them.

And so, y'all might count the coin that'southward being "saved" for future employ. This category includes interest-begetting accounts, time deposits (such as certificates of eolith, which pay interest after a designated menstruation of time), and money market common fundsAccounts that pay interest to investors who puddle funds to make short-term loans to businesses and the government. , which pay interest to investors who pool funds to brand short-term loans to businesses and the authorities.

M-1 and M-2

Counting all this money would be a daunting task (in fact, it would be impossible). Fortunately, there's an easier mode—namely, past examining two measures that the government compiles for the purpose of tracking the coin supply: Yard-ane and 1000-ii.

- The narrowest measure, M-iMeasure of the money supply that includes only the well-nigh liquid forms of money, such as cash and checking-account funds. , includes the nigh liquid forms of money—the forms, such equally greenbacks and checking-accounts funds, that are spent immediately.

- M-2Measure of the coin supply that includes everything in M-1 plus near-cash. includes everything in G-i plus near-cash items invested for the short term—savings accounts, time deposits beneath $100,000, and money market mutual funds.

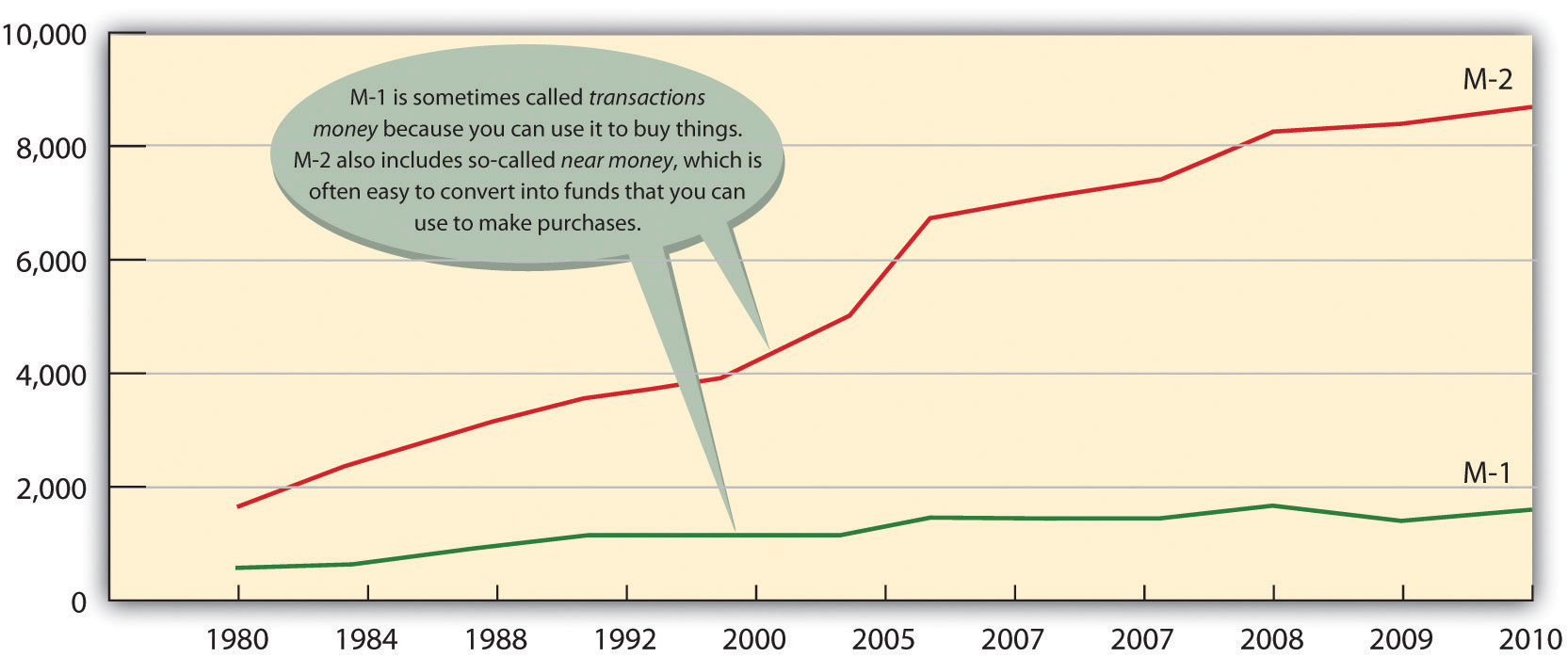

So what's the lesser line? How much money is out at that place? To find the answer, you tin get to the Federal Reserve Board Spider web site. The Federal Reserve reports that in September 2022, M-ane was virtually $2.1 trillion and M-2 was $nine.6 trillion.Federal Reserve, "Money Stock Measures," Federal Reserve Statistical Release, http://www.federalreserve.gov/releases/h6/electric current/ (accessed November half-dozen, 2022). Figure xiii.2 "The U.Southward. Money Supply, 1980–2010" shows the increase in the two money-supply measures since 1980.

Figure thirteen.ii The U.S. Money Supply, 1980–2010

If you lot're thinking that these numbers are too big to make much sense, yous're not alone. One way to bring them into perspective is to figure out how much money you'd become if all the money in the United states were redistributed equally. According to the U.S. Demography Population Clock,U.S. Census Bureau, "U.S. Globe Population Clocks," U.South. Census Agency, http://www.census.gov/main/www/popclock.html (accessed Nov vii, 2022). there are more than three hundred one thousand thousand people in the Us. Your share of M-1, therefore, would be nearly $6,700 and your share of M-ii would be nigh $31,000.

What, Exactly, Is "Plastic Coin"?

Are credit cards a form of money? If not, why do we telephone call them plastic money? Really, when you buy something with a credit card, you're not spending money. The principle of the credit card is buy-at present-pay-later. In other words, when you use plastic, you lot're taking out a loan that you intend to pay off when you get your nib. And the loan itself is not money. Why non? Basically because the credit card company can't use the nugget to buy anything. The loan is merely a hope of repayment. The asset doesn't become money until the bill is paid (with interest). That's why credit cards aren't included in the calculation of Thou-ane and Yard-2.

Fundamental Takeaways

-

Money serves iii basic functions:

- Medium of commutation: because y'all can use it to buy the goods and services you want, everyone's willing to trade things for money.

- Measure out of value: it simplifies the commutation process because information technology'southward a means of indicating how much something costs.

- Store of value: people are willing to hold onto it because they're confident that it volition go on its value over fourth dimension.

- The government uses two measures to track the money supply: M-1 includes the nigh liquid forms of money, such as greenbacks and checking-account funds. M-2 includes everything in M-1 plus nigh-cash items, such equally savings accounts and fourth dimension deposits below $100,000.

Exercise

(AACSB) Analysis

Instead of coins jingling in your pocket, how would y'all like to take a pocketful of cowrie shells? These smooth, shiny snail shells, which are abundant in the Indian Ocean, have been used for currency for more than four thousand years. At 1 point, they were the virtually widely used currency in the world. Search "cowrie shells" on Google and learn as much as y'all can about them. And then reply the following questions:

- How effectively did they serve as a medium of exchange in ancient times?

- What characteristics fabricated them similar to today'southward currencies?

- How effective would they be as a medium of exchange today?

Source: https://saylordotorg.github.io/text_exploring-business-v2.0/s17-01-the-functions-of-money.html

Posted by: lovecagaince1973.blogspot.com

0 Response to "What Are Three Basic Functions Of Money?"

Post a Comment